Colombia’s foreign debt continues to grow

Colombia’s foreign debt increases every year, both total and public, which implies allocating a larger budget to pay it. Bondholders and multilateral organizations are the main lenders.

Colombia’s foreign debt continues to grow. This includes private debt, which refers to debt contracted abroad by non-state companies and households, and public debt, which refers to debt acquired by state institutions abroad.

The behavior of public foreign debt is worrisome. This went from being 13% of GDP, in 2013, to represent more than 30% of GDP in the last 3 years. This is shown by information from the Central Bank of the Republic (BanRep).

You may read: Africa’s economy: what’s next for the cradle of humanity?

Colombia’s foreign debt increases year after year

In August 2023, Colombia’s foreign debt closed the month at USD $190,221 million. This represents a growth of 6.9% compared to the same month of the previous year and 3.4% compared to the final figure of December 2022, according to Cedetrabajo’s calculations.

In the first eight months of 2023, the average weight of Colombia’s total foreign debt was 55.5% of GDP, calculated based on BanRep data. This percentage is higher than at the end of 2022, when it stood at 53.4% of GDP.

Colombia’s public foreign debt grows in relation to GDP

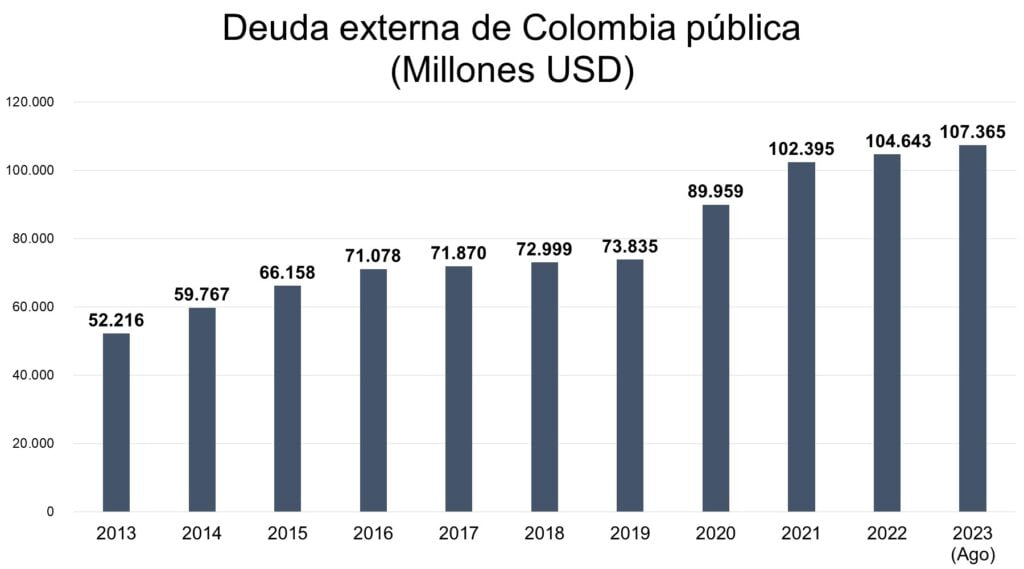

In August 2023, Colombia’s public external debt reached USD $107,365 million. This means an increase of 2.6% with respect to the closing value of December 2022 (USD $104,643 million) and of 6.4% compared to August 2022 (USD $100,872 million), according to data from Banco de la República.

In the last nine years, between 2013 and 2022, public external debt grew annually at 8% on average. The years in which it increased the most were 2020 and 2021, with growth of 21% and 13%, respectively, according to Cedetrabajo’s calculations.

Between January and August 2023, Colombia’s foreign public debt represented an average of 31.6% of GDP. The highest month was July, when it reached 32.4% of GDP. This percentage exceeds all the months of 2022, a year that closed with a public external debt equivalent to 30.4% of GDP.

The figure is alarming, especially considering that 10 years ago, in 2013, it represented 13.7% of GDP (BanRep).

Colombia’s foreign debt: what the country has paid in 2023

Foreign debt service can be understood as what a country pays in capital amortization and interest to its external creditors. The higher the public external debt, the more must be allocated annually from the general budget to service the debt.

In all of 2013, Colombia’s public foreign debt service was USD $4,142 million. In contrast, in 2022, USD $8,302 million was allocated to service the public external debt, according to BanRep.

Between January and August 2023, Colombia’s public foreign debt service was USD $7,815 million. This figure is divided into two items: USD $4,431 million for amortizations and USD $3,383 million for interest.

You may also read: Obstacles for the military industry to become a hub for the country’s reindustrialization

To whom Colombia owes

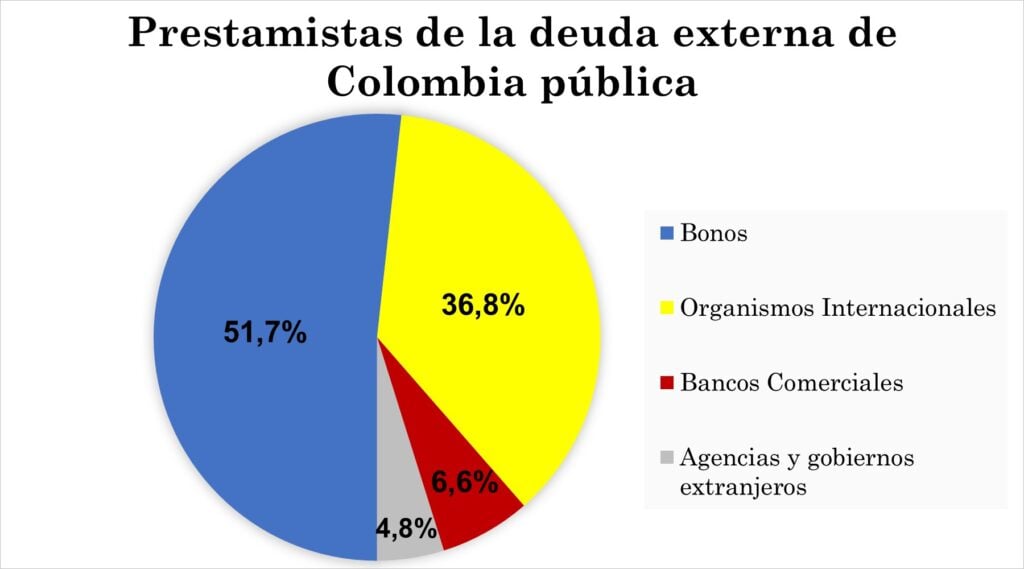

51.7% of Colombia’s public sector foreign debt is in the hands of bondholders in the international market, according to the latest BanRep report dated as of the first half of 2023.

A report by El Espectador in 2021, after consulting several experts, concluded that “it is difficult to determine who holds Colombian bonds in dollars”. And a note by Revista Cambio, published in January 2023, said that “Colombia does not know for sure in whose hands these debt securities are” when talking about bonds sold abroad.

Although the foreign creditors of the Colombian bonds are not known with certainty, it is known that they include capital funds from the United Arab Emirates, Saudi Arabia and Kuwait, and pension funds from the United States and the Netherlands. The main creditors of the bonds are estimated to be European, Asian and U.S. creditors, according to reports by El Espectador and Revista Cambio.

The second largest lenders of Colombia’s public foreign debt are international organizations, owed 36.8% of the debt as of June 2023, according to BanRep. The International Bank for Reconstruction and Development, part of the World Bank, is the organization owed the most, with 14.3% of the public foreign debt.

The Inter-American Development Bank (IDB) is the second most owed international organization, with 11% of the total public external debt. The International Monetary Fund, the International Development Association, the Andean Development Corporation and the International Fund for Agricultural Development add another 11%, according to BanRep.

In addition, commercial banks are the lenders of 6.6% of Colombia’s public foreign debt, as of June 2023.

Foreign agencies and governments are the creditors of the other 4.8%. This group includes the United States Eximbank, the German State Development Bank, the French Development Agency, the French Government, the Export Development Corporation of Canada and development banks of European countries.

More than 300 millionaires, economists and global leaders unite for higher taxes on the wealthy