What about Ecopetrol’s results? the company and the union celebrated, but revenues and profits fell sharply

In a world where oil continues to be key to its operation, Ecopetrol’s latest results have set off alarm bells in Colombia. The company said yesterday afternoon, August 8, that the second half of 2022 was “the second best half in Ecopetrol’s history (in the same period)”.

You may be interested in: Attention, citizens: the DIAN will launch a new platform to file the 2023 income tax return

#ResultadosEcopetrol | Logramos el segundo mejor semestre en la historia de Ecopetrol💚. Avanzamos en resultados operacionales, gestión comercial y en eficiencias. Mostramos resiliencia y compromiso⚡️ con el crecimiento del grupo, en un entorno desafiante. pic.twitter.com/WK3oz7Betr

— Ecopetrol (@ECOPETROL_SA) August 8, 2023

The company celebrated the increase in production, since it achieved an average of 728 thousand barrels equivalent per day (kbd), that is, 23 thousand barrels more per day than in 2022. It also celebrated the compensation of 35 thousand tons of CO2, a record refinery load of 428 kbd and an increase of 20.3% in the volume transported, with 1,097.7 kbd. It also said it showed “resilience and commitment to the group’s growth in a challenging environment”.

However, it seemed to forget that, beyond factors such as the increase in production and the greater contribution to the care of the environment, the state-owned company -key for public finances and the financing of social spending- must strive to have positive behaviors in revenues and profits.

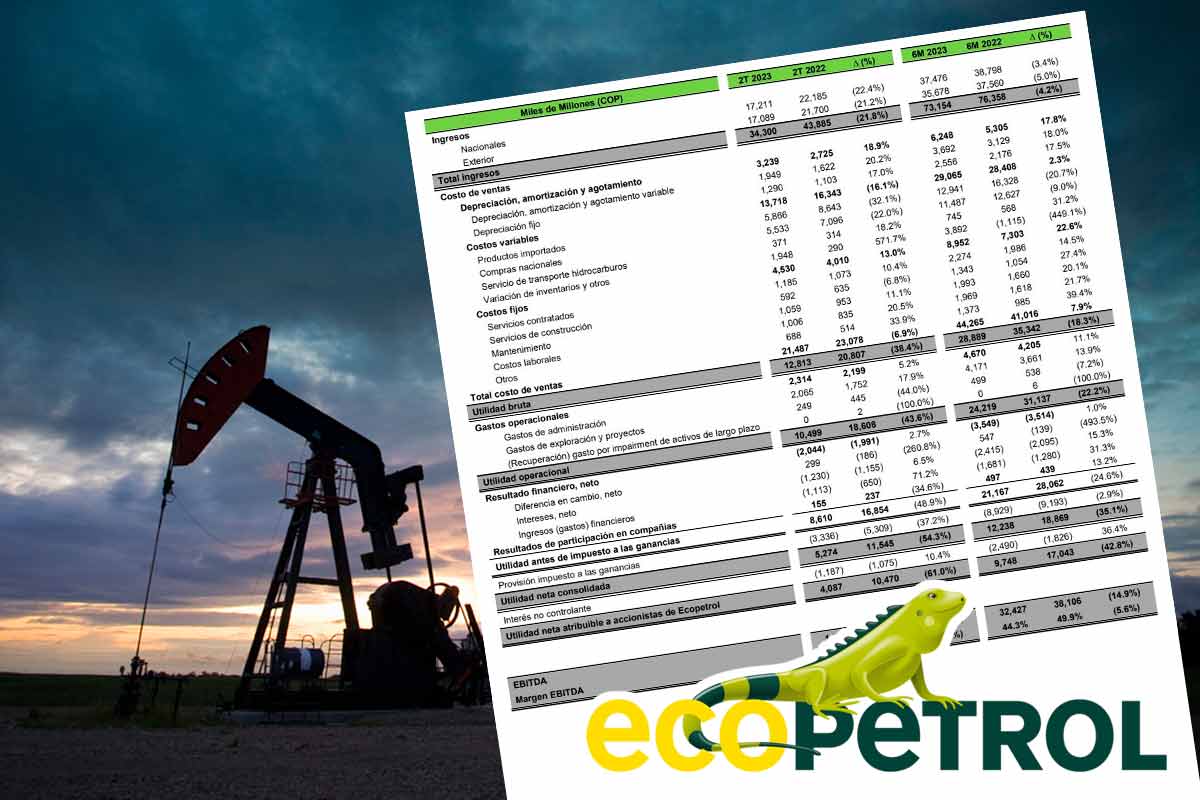

In fact, and despite the optimism of the presentation of Ecopetrol’s report, experts on the subject highlighted the negative figures in net profit, gross profit and the value of revenues, three key aspects for any company, and even in the value of taxes, since the company had an additional 2.2 billion in taxes, as a result of the last tax reform, approved in the first year of Gustavo Petro’s government.

Alerts are raised due to the fall of Ecopetrol’s net profit and revenues

According to Ecopetrol’s results for the second quarter of 2023, presented by its president Ricardo Roa, the company’s net income suffered a 61% drop compared to the same period of 2022. This means that, while in the second quarter of 2022 Ecopetrol’s net profit was $10.4 billion, in the same months of this year it was only $4.1 billion. On the other hand, gross profit fell 38.4%.

This was presented by journalist JuanDa Galindo in his Twitter account, who published the table with the comparative values between periods.

#Atención

— JuanDa Galindo (@CallMeJuanda) August 8, 2023

Salieron los resultados de @ECOPETROL_SA del segundo trimestre del año y no son muy buenos que digamos.

La utilidad neta fue de $4 billones, 61% menos que en el mismo periodo del año pasado. Los ingresos bajaron 21,8% y la utilidad bruta 38,4% pic.twitter.com/p4X6wBuD1Y

In addition to the drop in Ecopetrol’s net and gross profit, it can be seen that revenues decreased 21.8% compared to the same period of the previous year. In the second quarter of 2022, the company reported $43.8 billion in revenues, compared to $34.3 billion in the second quarter of 2023.

Another critical voice against the report presented by Ricardo Roa was that of Sergio Cabrales, energy expert, who in his Twitter account warned about the loss of value of Ecopetrol’s shares in the Colombian Stock Exchange, as a result of the publication of the results:

Tras los resultados del segundo trimestre de 2023, el precio de la acción de @ECOPETROL_SA sufre una caída del 4.78% en la @bvcColombia 🫣 pic.twitter.com/NUD8Vr2JvB

— Sergio Cabrales (@SergioCabrales) August 9, 2023

You may also be interested in: You can still register your ID card to vote in the next elections: this is the deadline and what you should do if you have changed your residence or have not registered your ID card yet

USO celebrated

Faced with these criticisms, the Unión Sindical Obrera (USO), Ecopetrol’s union, came out in support of the results achieved by the company in the second quarter of this year.

The USO referred to the “positive results” of the company, in relation to the production of barrels of oil per day, the fact that the company delivered 23.6 billion pesos to the State and the leading role of Ecopetrol in the supply of natural gas, gasoline and diesel, as has been the case for decades.

Surprisingly, it also celebrated the half-yearly revenues and profits, without contrasting them with the results of other periods. Had it done so, the negative results in net income, revenues and gross profit would have been evident.

#FelizMiercoles @ECOPETROL_SA ha publicado sus resultados económicos para el 2o trimestre del 2023. Este es nuestro análisis de esos resultaods positivos. #UnAnoDeLogros @danielsossa9 @cesarloza01 @mlorozco78 @fabioariascut @PercyOyola_CGT @maltescut1 @IndustriALL_GU @CTColombia pic.twitter.com/fcKd2ASSjQ

— USO Colombia (@usofrenteobrero) August 9, 2023

Oil is still king

To better understand the magnitude of the global crude oil market, the Elements Visualcapitalist portal – specializing in visualization of energy and minerals information – made a comparison between the world’s oil market and the top 10 metals markets combined in terms of production value.

The top 10 metals markets in the world are composed of iron, gold, copper, aluminum, nickel, zinc, silver, molybdenum, palladium and lead. Within the group, gold is the most expensive metal, with a price per ton that is over USD $63 million.

Well, according to Elements Visualcapitalist, the global oil market surpassed by more than USD $2.1 trillion the production value of the world’s top 10 metals during 2022.

This commercial behavior of crude oil also covers Colombia, since the country’s main income comes from oil and hydrocarbons.

Keep reading: The beginning of the end of remote work? Zoom employees asked to return to the office